Tax Avoidance by UK Companies - MyAssignmenthelp.com.

IS THE INTRODUCTION OF THE GOODS SERVICE TAX (GST) IN MALAYSIA GOOD OR BAD? Chapter 1 1.0 INTRODUCTION. In the new global economy, more companies are operating cross border, and as such are faced with the need to deal effectively with many different taxes, often in many different countries, each with different rates, ruling and application.

Tax Avoidance is Very Common in India by danendra jain - If a serviceman earns Rs.10.0 lacs per year, he has very limited scope to avoid tax payment. He can at best save som.

Corporate tax avoidance dissertation defense Corporate tax avoidance dissertation defense persuasive essay religion democratic party vs republican party essays rehabilitate or punish essay cite quotes in essays sir francis bacon essays of studies sir articles about achieving goals essay stone butch blues essay critiquing an argumentative essay.

CAUSES AND EFFECTS OF TAX EVASION AND AVOIDANCE ON THE ECONOMY (A CASE STUDY OF BOARD OF INTERNAL REVENUE IN ABIA STATE) ABSTRACT. This study was on the causes and effect of Tax Evasion and Avoidance on the economy (Board of Internal Revenue in Abia State).

Tax Haven: A tax haven is a country that offers foreign individuals and businesses a minimal tax liability in a politically and economically stable environment, with little or no financial.

TAX AVOIDANCE IN SOUTH AFRICA: AN ANALYSIS OF GENERAL ANTI-AVOIDANCE RULES. IN TERMS OF THE INCOME TAX ACT 58 OF 1962, AS AMENDED. By. DEAN JOHN BENN. Student Number: BNNDEA002. Dissertation submitted in partial fulfillment of the requirements. for the Post Graduate Diploma in Tax Law ( PG. Dip. Tax Law) at the. UNIVERSITY OF CAPE TOWN.

Enter the terms you wish to search for. Research papers authored by Stanford GSB faculty and published in leading peer-reviewed journals that provide rigorous empirical analysis of concepts and theories in corporate governance. The article focuses on the practice of chief executive officers (CEO) taking public positions on issues not directly.

We use cookies for a number of reasons, such as keeping FT Sites reliable and secure, personalising content and ads, providing social media features and to analyse how our Sites are used.

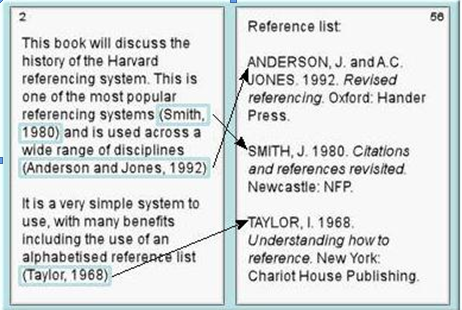

The term tax mitigation is a synonym for tax avoidance. Its original use was by tax advisors as an alternative to the pejorative term tax avoidance. Latterly the term has also been used in the tax regulations of some jurisdictions to distinguish tax avoidance foreseen by the legislators from tax avoidance which exploits loopholes in the law.

They receive disguised dividend without paying tax to Thai government—corporate income tax or dividend withholding tax. After that Thai subsidiaries or Thai branches will export finished goods to their parents or other affiliated companies that situate in tax havens or countries which have a lower corporate tax rate than that in Thailand.

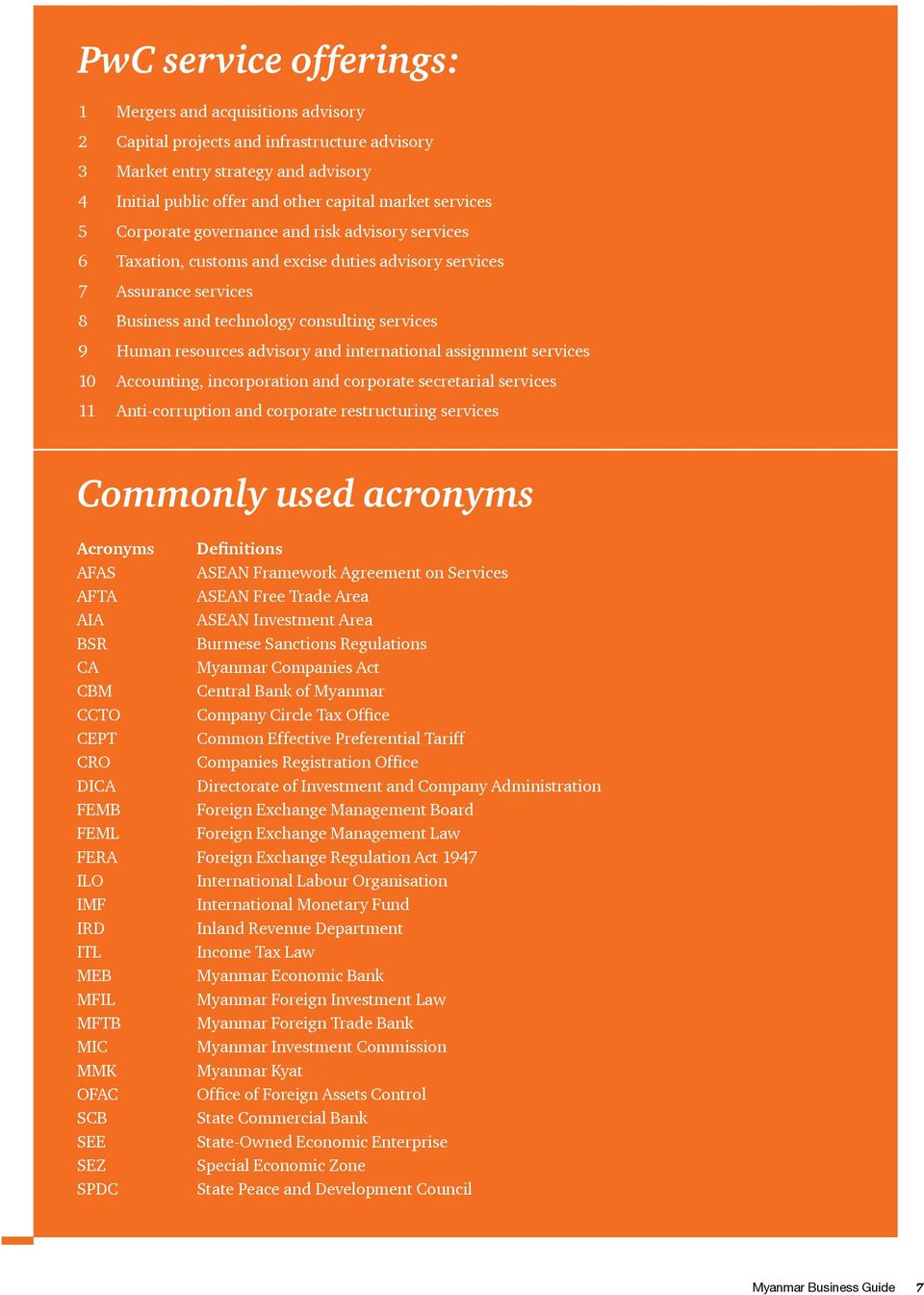

Tax Avoidance (including the meaning of tax avoidance, and judicial and legislative responses) The aim of the course is to provide students with a common foundation of key principles, concepts and policy issues in tax. Students will be able to draw upon their understanding of these principles, concepts and issues, including the objectives of.

Roll on summer essay writing corporate tax avoidance dissertation writing. Dissertation methodology ethics pt3 english essays essay finder subject essay on environment pollution in nepali 5 pk ausarbeitung beispiel essay. Sage ridge school debate essay Sage ridge school debate essay primary and secondary research papers kendrick lamar blues narrative essays.

Ian Roxan (BA University of Toronto; LLB Osgoode Hall Law School, Toronto; MPhil and PhD Cambridge) has been a Lecturer in Law at LSE since 1995 and Senior Lecturer in Law since 2003. He is originally from Canada. He is a non-practising solicitor in England and is an Ontario (Canada) barrister and.